About Us

Industrial Equipment Capital (IEC), offers tailored equipment financing and leasing solutions to businesses Nationwide.

As an equipment financing company with over 80 years of experience in business lending solutions, our team of dedicated professionals has the knowledge, expertise, and resources to help your business secure the financing it needs to grow. We are committed to being a trusted partner in your success, supporting your company every step of the way. Where traditional lenders fall short, IEC steps in with simple, flexible, and fast financing solutions to meet your business needs.

OUR VALUES

Innovative Financial Solutions from Professionals You Can Trust.

We take pride in delivering on our promises and building strong client relationships. Staying at the forefront of emerging technology, we serve industries that big banks often can’t — all while keeping a customer-oriented approach designed to support your company’s growth.

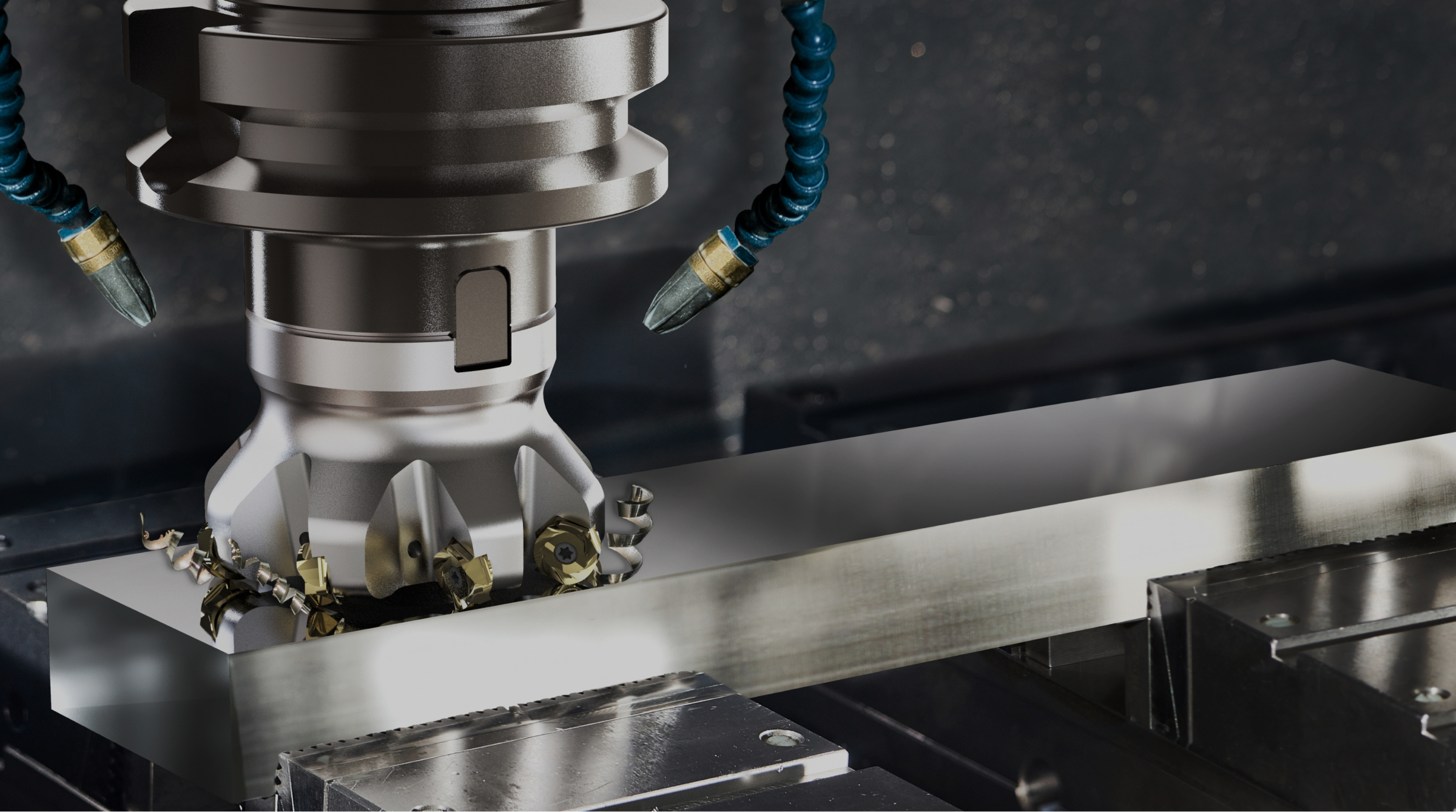

Why Choose IEC for your Manufacturing Equipment Financing Needs?

We personalize and custom-tailor our services so that we can take care of all your equipment finance needs. Although our focus when we began was on financing machine tools, we now offer manufacturing business loans and leases for a broad array of equipment, including woodworking equipment, stone equipment, forklifts, 3D printing machines, and more. Our approval process is quick, our documentation is simple, and our experienced team will work with you to understand what your company needs are and what solutions we can provide.

Easy, One-Page Application

IEC can finance a particular customer multiple times without reviewing their financial statements. Our one-page application ensures you get your equipment easier and faster than ever before.

No Blanket Liens

Unlike traditional banks, IEC doesn’t require additional collateral. We only use the collateral we are financing as a security interest. We want your company to grow and will support your continued success.

Experience You Can Trust

Our team of manufacturing finance experts works to understand your unique business needs and create a customized financing package, whether it’s your first time working with us or you’ve been with us for years.

OUR STORY

Industrial Equipment Capital (IEC) was founded by Matt Kooba, after spending years working at one of the nation’s top five banks.

Industrial Equipment Capital (IEC) was founded by Matt Kooba, after spending years working at one of the nation’s top five banks. While there, he noticed the limitations of traditional lenders, who required extensive financial packages for every transaction, creating unnecessary obstacles for customers. Matt envisioned a more straightforward and personalized process, where equipment financing could be approved within a day or two without extensive applications and long delays.

His idea led him to create Industrial Equipment Capital, which offers a customized and personable experience for every client, with quick, easy-to-understand business capital solutions. With a dedicated team who share Matt’s passion for helping businesses grow, IEC creates lasting partnerships, ensuring that customers don’t just choose IEC for their first equipment purchase — they turn to IEC every time.

By doing what other business lenders can’t, IEC has established itself as the go-to equipment loan company for businesses seeking simpler, faster financing solutions.